2024-02-24

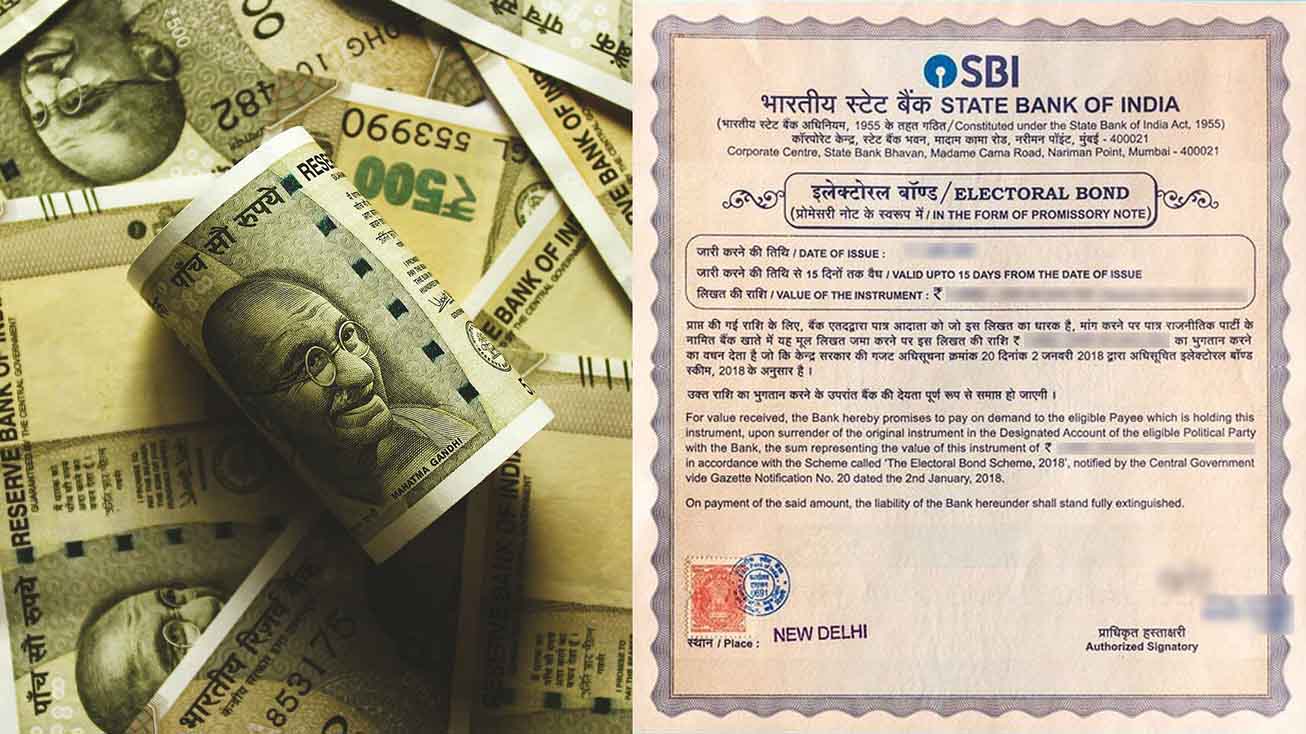

Electoral bonds are interest-free bearer instruments, which means that they are payable to the bearer on demand, similar to a promissory note. The scheme allows corporations and individuals to anonymously donate money to political parties by purchasing electoral bonds from the State Bank of India (SBI). Notably, the SBI has sole access to the details of those who purchased electoral bonds. According to the scheme, the proceeds from any bonds, which are not encashed within 15 days of being issued, are to be deposited in the Prime Minister Relief Fund.

BACKGROUND OF PRESENT SCENARIO

- Electoral Bond scheme was challenged shortly after it was announced in January 2018, by a number of parties, including the Communist Party of India (Marxist), Common Cause and the Association for Democratic Reforms (ADR).

- The Election Commission also filed an affidavit to the SC on some provisions in the scheme, which can have serious repercussions on political funding in the country.

- The case was heard by a 5-judge constitution bench of the Supreme Court led by Chief Justice of India for three days from October 31 to November 2 last year.

- The Supreme Court gave its final verdict on February 15.

- It Struck down the Electoral Bond and associated amendments as unconstitutional.

- The SC asserted that the Electoral Bond violated the fundamental right to information guaranteed under Article 19(1) (a) of the Constitution.

RATIONALE BEHIND INTRODUCTION OF ELECTORAL BONDS

- To curb black money

- To reduce using illicit means of funding and the system was wholly opaque and ensured complete anonymity.

- Payments made for the issuance of the electoral bonds are accepted only by means of a demand draft, cheque or through the Electronic Clearing System or direct debit to the buyers’ account.

- Limiting the time for which the bond is valid ensures that the bonds do not become a parallel currency.

- Eliminate fraudulent political parties

- That were formed on pretext of tax evasion, as there is a stringent clause of eligibility for the political parties in the scheme.

- Protects donor from political victimization

- As non-disclosure of the identity of the donor is the core objective of the scheme.

KEY ELEMENTS OF INDIA’S ELECTORAL BOND SCHEME

- Donor Eligibility

- Donors must be citizens of India or entities incorporated or established in India.

- Bonds can be purchased individually or jointly with other individuals.

- KYC (Know Your Customer) details must be provided by every donor, with their names kept confidential.

- Receiver Eligibility

- Only political parties registered under Section 29A of the Representation of the People Act, 1951, and securing at least one percent of the votes in the last General Election are eligible to receive the bonds.

- Authorized Bank

- Electoral bonds can only be encashed by eligible political parties through a bank account with the authorized bank.

- The State Bank of India (SBI) was authorized to issue and encash bonds through its 29 designated branches.

- Denominations

- Bonds are issued in denominations of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh, and Rs 1 crore.

- Validity

- Electoral bonds are valid for fifteen calendar days from the date of issue.

- Bonds deposited by eligible political parties in their accounts are credited on the same day.

CONCERNS RELATED TO ELECTORAL BONDS

- Lack of Transparency

- Donors and recipients remain undisclosed, leading to concerns about hidden influence and biased policy decisions.

- Potential for Undue Influence

- Anonymity opens doors to quid pro quo scenarios where donors seek favorable policies in return for donations.

- Unequal Playing Field

- Larger political parties benefit from attracting more significant anonymous donations, creating an uneven playing field.

- Misuse of State Machinery

- Ruling parties may gain leverage by accessing donor information through the State Bank of India (SBI), potentially influencing donors' decisions.

- Impact on Policy Decisions

- Policies might be skewed in favor of big donors, compromising governance and public interest.

- Money Laundering Risk

- Anonymity in electoral bonds could facilitate the laundering of illicit funds, posing a risk to the integrity of the political financing system.

CONCERNS HIGHLIGHTED BY INSTITUTIONS

Reserve Bank of India (RBI):

- RBI objected to allowing other banks to issue electoral bonds, fearing it could undermine trust in banknotes and the financial system.

- RBI raised concerns that the anonymity of intermediate transactions could violate anti-money laundering principles, suggesting alternative payment methods like cheques or electronic transfers.

- The central bank warned of the potential misuse of electoral bonds by shell companies for money laundering and forgery, posing a threat to financial integrity.

Election Commission of India (ECI)

- ECI highlighted the lack of transparency due to anonymous donations through electoral bonds, preventing reporting under the Representation of the People Act and hindering transparency in political funding.

- The Commission expressed concerns that unlimited corporate funding through electoral bonds could increase the risk of black money usage, especially through shell companies.

SUPREME COURT'S VERDICT ON THE ELECTORAL BONDS

- Invalidation of the Scheme

- The Court struck down the Electoral Bonds Scheme on the grounds that it violated the voters' right to information about political funding, as guaranteed under Article 19(1)(a) of the Constitution.

- It emphasized that the right to know takes precedence over donor anonymity in political party funding.

- Invalidation of Legal Amendments

- Additionally, the Court invalidated the amendments made to various laws such as the Representation of the People Act, the Companies Act, and the Income Tax Act, which facilitated the implementation of the Electoral Bonds Scheme.

- These amendments were deemed to compromise the transparency and integrity of the electoral process.

- Concerns about Corruption and Quid Pro Quo

- The Court expressed concerns regarding potential corruption and quid pro quo arrangements facilitated by the scheme and its associated amendments.

- It highlighted the risk of corporations exerting undue influence on the electoral process in exchange for favorable policy changes or licenses.

- Emphasis on Democratic Principles

- The verdict underscored the importance of upholding democratic principles, particularly the principle of one person, one vote.

- It argued that economic inequality in political contributions undermines these principles and poses a threat to free and fair elections.

GROUNDS ON WHICH SC HELD ELECTORAL BONDS TO BE UNCONSTITUTIONAL

- Violation of Right to Information

- The anonymity of electoral bonds was deemed to violate the right to information of voters and citizens, as well as the transparency of political funding implicit in Article 19 (a) of the Constitution.

- Access to information about the funding of political parties was considered essential for voters to make informed choices in a democracy.

- Breach of Equality Principle

- The scheme discriminates among political parties based on their vote share, favoring the ruling party and major opposition parties over smaller and regional parties.

- This unfair advantage distorts the level playing field in politics. Additionally, the scheme creates a disparity between donors and voters, allowing donors to exert influence over political decisions while keeping voters uninformed.

- Contravention of Constitutional Electoral Reforms

- The Electoral Bonds scheme runs counter to the constitutional objective of combating corruption and criminalization in politics.

- . Furthermore, the scheme conflicts with the Representation of Peoples Act, 1951, which mandates political parties to disclose their contributions and expenditures, thus undermining the electoral reform framework.

- Potential for Quid-Pro-Quo Arrangements

- The opacity of financial support for political parties was seen as potentially leading to quid-pro-quo arrangements due to the close nexus between money and politics.

- Failure to Meet the Restrictive Means Test

- The Electoral Bonds scheme was found to fail the restrictive means test of the doctrine of proportionality.

- The court noted that there are alternative means to curb black money other than electoral bonds.

SUPREME COURT DIRECTION

- State Bank of India (SBI), which issues electoral bonds, has been directed to cease issuing these bonds immediately.

- As per the court's directive, the SBI must provide details of political parties that received electoral bonds since 2019 to the Election Commission of India (ECI) by March 6. Subsequently, the ECI is tasked with publishing these details on its official website.

KEY LAWS INVALIDATED BY THE SUPREME COURT

- Representation of the People Act, 1951 (Section 29C)

- Original Provision: Required reporting of donations over Rs 20,000 by political parties.

- Finance Act, 2017 Amendment: Exempted donations through Electoral Bonds from reporting.

- Supreme Court Verdict: Struck down the amendment, balancing voters' right to information and donor privacy.

- Companies Act, 2013 (Section 182)

- Original Provision: Limited corporate donations and required disclosure.

- Finance Act, 2017 Amendment: Removed donation cap and disclosure requirement.

- Supreme Court Verdict: Invalidated the amendment due to potential undue corporate influence.

- Income-tax Act, 1961 (Section 13A)

- Original Provision: Required disclosure of donations over Rs 20,000.

- Finance Act, 2017 Amendment: Excluded Electoral Bond donations from disclosure.

- Supreme Court Verdict: Reversed the changes, citing violation of voters' right to information.

IMPLICATION OF SUPREME COURT JUDGEMENT

- Enhanced Transparency and Accountability

- The ruling will lead to greater transparency and accountability in political funding.

- With the disclosure of the source and amount of funding received by political parties through electoral bonds, the public will have the means to scrutinize party finances and hold them accountable for their actions and decisions.

- Reduction of Money and Corporate Influence

- By removing the veil of anonymity surrounding donors, the judgment aims to reduce the influence of money and corporate power in politics.

- With donors unable to conceal their identities, there will be less opportunity for undue influence and lobbying by vested interests, leading to a more equitable and democratic political process.

- Levelling the Playing Field

- The verdict seeks to level the playing field for all political parties. By ensuring that parties are not discriminated against based on their size or popularity, smaller and regional parties will have a fair chance to compete with larger parties.

- This will promote diversity and pluralism in the political landscape, offering voters a genuine choice in elections.

GOVERNMENT’S ARGUMENTS FOR THE ELECTORAL BONDS

- Reduce Cash Usage

- By mandating payments through formal banking channels, like demand drafts or cheques, the scheme aimed to enhance transparency in political financing.

- Combat Black Money

- KYC procedures for buyers and disclosure requirements for recipient parties helped prevent the circulation of illicit funds, ensuring transparency in contributions.

- Protect Donor Anonymity

- Donors' identities were kept confidential to prevent potential coercion, while banking records deterred misuse.

- Enforce Safeguards

- Stringent KYC compliance and eligibility criteria for political parties ensured the scheme's integrity, preventing fraudulent activities.